Obtain secure access to your Employees’ Provident Fund (EPF) account with ease through the EPFO login portal. By utilizing the unique Universal Account Number (UAN), individuals can effectively manage their EPF passbook, check their EPF balance, and file claims online. These essential features streamline the process for beneficiaries, ensuring seamless access to important financial information and services.

For individuals with multiple EPF accounts, the UAN login allows for consolidation of all accounts under one umbrella, simplifying the tracking and management of their EPF funds. This comprehensive guide will provide step-by-step instructions for EPFO login, UAN login, accessing the EPF passbook, checking EPF balance, and filing claims online. Stay informed and empowered with the necessary tools to effectively manage your EPF accounts and secure your financial future.

Key Takeaways:

- EPFO Login: UAN Login, EPF Passbook, EPF Balance Check & Claim Online are all accessible through the EPFO login portal, which provides easy access to various EPF services.

- UAN Login: The Universal Account Number (UAN) is a unique identification number for every EPF member. Through UAN login, members can access their EPF passbook, check their EPF balance, and make online claims.

- EPF Balance Check & Claim Online: With the UAN login, EPF members can conveniently check their EPF balance and submit online claims for withdrawal, pension, or settlement, reducing the need for physical paperwork and visits to EPFO offices.

Understanding EPFO

Assuming you are a working professional in India, it is crucial to have a clear understanding of the Employee Provident Fund Organization (EPFO). Established in 1951, EPFO is a statutory body under the Ministry of Labour and Employment, Government of India. It is responsible for administering a compulsory contributory provident fund scheme, pension scheme, and an insurance scheme for all employees.

What is EPFO?

One of the most significant social security organizations in India, EPFO aims to secure the financial future of employees in various establishments and industries. It functions under the purview of the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952, and plays a crucial role in ensuring retirement, medical, and family benefits for employees. With the introduction of the Universal Account Number (UAN) in 2014, EPFO has taken significant steps towards streamlining and simplifying the provident fund management system.

Functions and Benefits of EPFO

EPFO performs several functions to ensure the financial security of employees, such as overseeing the implementation of the Employees’ Provident Funds and Miscellaneous Provisions Act, registering establishments, enrolling members, and facilitating the transfer and withdrawal of funds. Furthermore, EPFO provides benefits such as employee pension schemes, insurance schemes, and the provision of pension to the family in case of the employee’s untimely demise. The organization also offers online services for members to check their EPF balance, download EPF passbook, and file claims.

Also Read : MPPEB Result 2023

This ensures that employees have easy access to their provident fund details, facilitating transparency and convenience in managing their retirement savings. Employees can also enjoy various tax benefits and the assurance of a secure financial future through EPFO’s initiatives.

The Universal Account Number (UAN)

Some of you may be familiar with the term Universal Account Number (UAN) when it comes to dealing with your EPF account. In this chapter, we will delve into the details of what exactly the UAN is, how to obtain and activate it, and why it is important for managing your EPF account.

Also Read : Highrich

What is UAN?

Universal Account Number (UAN) is a unique 12-digit number assigned to each member of the Employees’ Provident Fund Organization (EPFO). It acts as an umbrella for multiple member IDs allotted to an individual by different establishments. This means that regardless of how many times you change your job, your UAN remains the same. The UAN allows for integration of multiple Member Identification Numbers (Member Id) allotted to a single member under single UAN.

The UAN remains valid for a lifetime, and it does not change with the change in jobs. Once the UAN is activated, it allows you to link all your member IDs and keep track of your EPF balance and other details through a single UAN interface.

How to Obtain and Activate Your UAN

To obtain and activate your UAN, you can approach your employer who will facilitate the same for you. The UAN can also be obtained and activated through the EPFO portal by the members. Once the UAN is activated, the member can link all the member IDs provided by current and previous employers to the UAN. This process helps the member in keeping track of all the EPF contributions throughout their employment history.

Obtaining and activating your UAN is an essential step in managing your EPF account effectively. It streamlines the process of checking your EPF balance, passbook, and initiating EPF withdrawal and transfer claims online, making it a crucial aspect of your financial planning and management.

Also Read : Egerp Panipat

EPF Passbook

The EPF passbook is an important document that provides a detailed record of all the transactions made in your Employees’ Provident Fund (EPF) account. It includes details such as contributions made by both the employer and the employee, interest earned, and withdrawals. It is essential for employees to regularly check their passbook to ensure that all contributions are accounted for and to keep track of their EPF balance.

Understanding the EPF Passbook

The EPF passbook is essentially a statement of your EPF account which provides a comprehensive overview of all the transactions made in the account. It includes details such as the date and amount of contributions made by both the employee and the employer, interest earned on the contributions, and any withdrawals made from the account. The passbook is crucial for employees to monitor their EPF account and ensure the accuracy of the transactions recorded.

How to Access and Interpret Your EPF Passbook

One can access their EPF passbook by logging into the EPFO portal using their Universal Account Number (UAN) and password. Once logged in, they can download and view their passbook to check details of their EPF transactions. It is important to carefully interpret the details in the passbook to ensure the accuracy of contributions and withdrawals. Employees should regularly review their passbook and report any discrepancies to their employer or the EPFO for rectification.

With the EPF passbook, employees can keep track of their contributions, interest earned, and withdrawals, ensuring transparency and accuracy in their EPF account. It is essential for employees to regularly monitor their passbook to stay informed about their EPF balance and ensure the security of their retirement savings.

EPF Balance Check

After making contributions to your EPF account, it’s essential to keep track of your balance to ensure that your retirement savings are on the right track. With the advancements in technology, checking your EPF balance has become more accessible and convenient than ever before.

Methods to Check EPF Balance

For individuals looking to check their EPF balance, there are several methods available. The most common and efficient method is through the EPFO portal, where you can log in using your UAN and password to access your account details. Additionally, you can also check your EPF balance via SMS or by using the UMANG app, which provides a user-friendly interface for checking your balance on your smartphone.

Understanding EPF Balance Statements

The EPF balance statement is a crucial document that provides a detailed breakdown of your contributions, interest earned, and the overall balance in your account. The statement includes information about the employee’s and employer’s contributions, ensuring transparency and accountability in the management of your EPF funds. The statement also serves as a record of your retirement savings, empowering you to make informed decisions about your financial future.

With the EPF balance statement, you can gain insights into your retirement savings and track the growth of your investments over time. It also allows you to verify that your contributions and interest calculations are accurate, giving you peace of mind about the security and growth of your EPF funds.

EPFO Login Process

Your EPFO login process is important for accessing various services offered by the Employees’ Provident Fund Organization. This includes checking your EPF balance, downloading your EPF passbook, and submitting a claim online. It is crucial to understand the EPFO login process to make the most of these services.

Step-by-Step EPFO Login Guide

Guide

| Step | Description |

|---|---|

| 1 | Go to the EPFO member portal |

| 2 | Enter your Universal Account Number (UAN) and password |

| 3 | Click on ‘Sign In’ to access your EPFO account |

During the EPFO login process, it is essential to ensure that you have the correct UAN and password to avoid any issues. Follow this step-by-step guide for a seamless login experience.

Troubleshooting Common Login Issues

StepbyStep

| Issue | Solution |

|---|---|

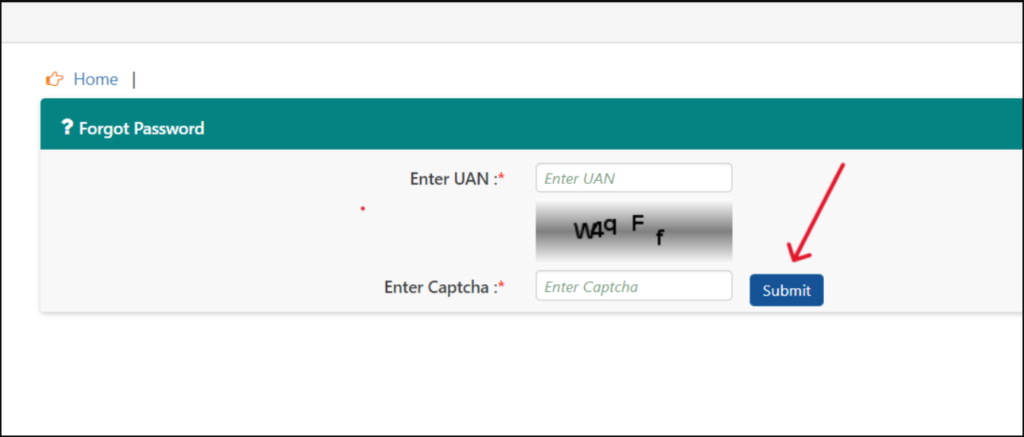

| Forgot Password | Reset your EPF password using the ‘Forgot Password’ link on the login page |

| Locked Account | Contact the EPFO helpdesk to unlock your account |

With the help of this troubleshooting guide, you can quickly resolve common login issues and access your EPF account without any hassle.

Claiming EPF Online

To claim your EPF online, you need to have an activated Universal Account Number (UAN) and should be linked with your Aadhaar, PAN and bank account details. With the introduction of online claims, the process has become much simpler and more convenient for EPF members.

Types of EPF Claims

There are three primary types of EPF claims that can be made online:

- Full EPF Withdrawal

- Partial EPF Withdrawal

- EPF Pension Withdrawal

This allows members to access their EPF funds based on their specific financial needs and circumstances.

Detailed Process for Online EPF Claims

The process for online EPF claims involves logging into the EPFO member portal using your UAN and password, and then selecting the relevant claim option. Subsequently, the member needs to enter the required details, including the reason for the claim and the amount being requested. After submission, the claim will be processed by the EPFO and the funds will be transferred to the member’s bank account.

Types of EPF claims can be made online, including full EPF withdrawal, partial EPF withdrawal, and EPF pension withdrawal. The process for online EPF claims involves logging into the EPFO member portal using your UAN and password, and then selecting the relevant claim option.

Managing Your EPF Account Online

Now that you have created your UAN login and accessed your EPF account online, it is important to know how to manage it effectively. This chapter will cover various aspects of managing your EPF account online, including updating personal information, linking Aadhaar with UAN, and utilizing UAN services for employees.

Updating Personal Information

Updating personal information in your EPF account is crucial to ensure that all your details are accurate and up-to-date. This includes information such as your name, date of birth, contact details, and nominee details. It is important to regularly review and update this information to avoid any discrepancies or issues in the future.

Linking Aadhaar with UAN

Aadhaar is a unique identification number issued by the Government of India, and linking it with your UAN is mandatory. Any changes to your Aadhaar details should be promptly updated in your EPF account to maintain accuracy and compliance with regulatory requirements. This process can be easily completed online through the EPFO portal.

Any employee who has been assigned a UAN can benefit from the various services provided by the EPFO. These services include online access to EPF passbook, checking EPF balance, and filing for EPF claims. It is essential for employees to take advantage of these services to effectively manage their EPF account and stay informed about their retirement savings.

UAN Services for Employees

Services such as accessing the EPF passbook, checking EPF balance, and filing for EPF claims can all be done conveniently through the UAN portal. Employees can also update their personal information, track the status of their claims, and access important documents related to their EPF account. It is important for employees to regularly utilize these services to stay informed about their EPF account and make informed decisions about their retirement savings.

Information such as updating personal details, linking Aadhaar with UAN, and utilizing UAN services for employees are crucial aspects of effectively managing your EPF account online. Regularly reviewing and updating personal information, linking Aadhaar with UAN, and taking advantage of the various services provided by the EPFO are all essential for a smooth and hassle-free experience with your EPF account.

Summing up EPFO Login – UAN Login, EPF Passbook, EPF Balance Check & Claim Online

EPFO Login provides a convenient platform for employees to access a variety of services related to their Employee Provident Fund (EPF) account. From UAN Login to checking EPF balance and claiming online, the EPFO portal offers a range of functionalities that make it easier for individuals to manage their retirement savings. With the use of UAN, employees can access their EPF passbook, track their contributions, and initiate a withdrawal or transfer request without the need for physical paperwork or visiting a local EPFO office. This online system not only enhances accessibility and transparency but also reduces the time and effort required for EPF related transactions.

By familiarizing yourself with the EPFO Login portal, employees can ensure that they are fully aware of their EPF account details and are able to make informed decisions regarding their retirement savings. The convenience and efficiency of the online services offered by EPFO Login provide employees with greater control over their EPF account and streamline the process of managing and accessing funds for their future. It is important for individuals to stay updated on the various features and benefits of the EPFO Login portal to take advantage of the resources available to them and make the most of their EPF account.

EPFO Login – UAN Login, EPF Passbook, EPF Balance Check & Claim Online FAQ

Q: How can I log in to my EPFO account?

A: To log in to your EPFO account, you need to visit the official EPFO portal and enter your Universal Account Number (UAN) and password. After entering the required details, you will be able to access your EPF passbook, check your EPF balance, and make online claims.

Q: What is UAN and how can I obtain it?

A: UAN, or Universal Account Number, is a unique identification number assigned to every member of the Employees’ Provident Fund Organization (EPFO). To obtain your UAN, you can check with your employer or visit the EPFO member portal to generate or retrieve your UAN. It is essential for accessing various EPFO online services, including UAN login, EPF passbook, and balance check.

Q: How can I check my EPF balance and download my EPF passbook online?

A: You can check your EPF balance and download your EPF passbook online by logging in to your EPFO account using your UAN and password. Once logged in, you can navigate to the ‘Passbook’ section to view and download your EPF passbook, which contains details of all your EPF contributions and interest earned. Additionally, you can also check your EPF balance under the ‘Member Passbook’ section and keep track of your retirement savings.