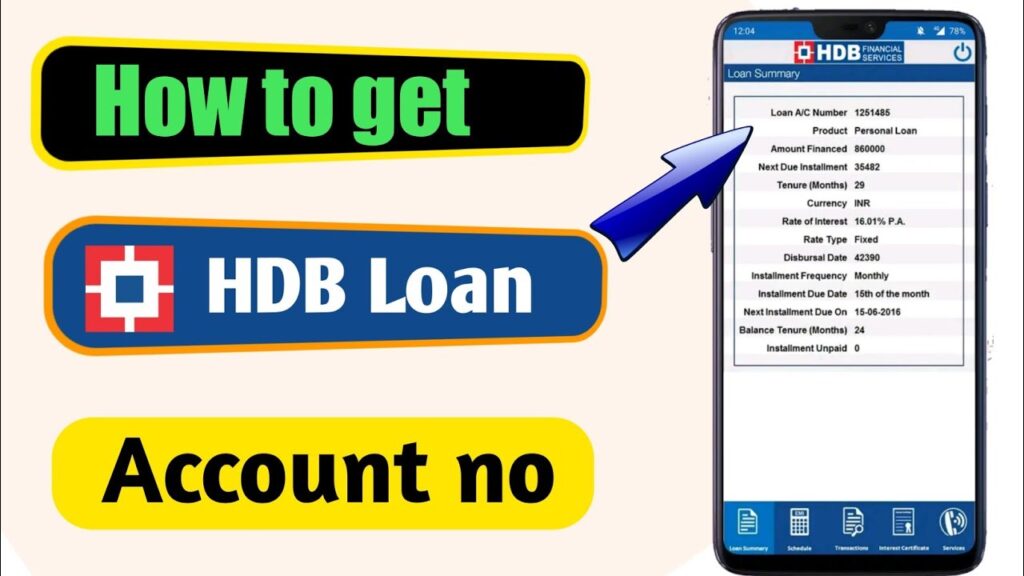

This HDB Personal Loan Login lets you verify how your loan is doing as well as keep track of your payments. You are also able to get in touch with customer support and obtain the loan statement.

Verify the status of your HDB personal credit status online

If you’ve submitted an application for an HDB individual loan, you can track your application status online. The bank offers a range of options for tracking your application with online and offline options.

To begin you’ll need to have the mobile phone number. In case you do not have one then you can get your number at the local branch. Once you’ve obtained an account number will be able to verify the status of your personal loan via the app or using the number toll free.

Utilizing the mobile application it is possible to view the balance as well as the history for your accounts. Then, you can pay off your loan. A individual loan report will reveal to you your monthly payments as well as the fees you’ve incurred.

When you check the personal loans, you’ll have to input your name and the date you were born. Then, you’ll have select the statement period. This will reveal the information about the loan, including the balance outstanding as well as the monthly installment amount as well as the repayment schedule.

You can also verify whether you are in compliance with your HDB Personal Loan status going to your branch. In accordance with the kind of loan you’ll have to provide a valid phone number. Then, you’ll get an email with directions for downloading your account statement.

If you’d like to know the HDB credit status while on the move You can download HDB on the Go. HDB On the Go application. It’s available on Android devices. Through the app, you are able to pay and see the history of your transactions.

Before you apply for a home loan, it is important to know the amount you’re able to afford. Knowing this can help you evaluate offers from various banks. The status of your loan will enable you to negotiate more favorable conditions to your bank.

The process of checking Your HDB credit status for personal loans is easy. You can dial the toll-free number, mobile app, or even visit your branch in person. If you’re seeking an easy, secure loan or just want to know more about your account at any time you want.

If you’re the first homeowner, you might be concerned about repaying the loan. HDBFS personal loans have attractive interest rates and flexible repayment time.

Make a copy of the statement for your personal credit

Personal loan statements are an absolute necessity if you plan to get a loan from a financial institution. The statement not only provides you with the necessary information regarding your loan, it will also give you an idea of your financial situation. It will provide you with information about the amount of your loans, withdrawals and other relevant information regarding your EMIs. Furthermore you can use it to prove the validity of the loan you have taken out.

This gadget can be found in your account at the bank, online or at the branch of your bank. The greatest thing is that it’s accessible through your mobile. To do this you need to get HDB on the go HDB to go application from the Google PlayStore. After you have downloaded the app, you’ll be able to examine how your account’s status is.

Another option is printing your personal loan statements in the bank. But, you could pay the fee of S$20 per month. If you’ve got your ID and password, you will be able to access this vital information.

If you’re a holder of the HDB credit, then you are able to print your statement , or mail your own copy. When you’ve got your statement, you will be able to pay your loan. The statement will reveal your balance due and the monthly installment amount as well as the interest rate you’re paying, as well as any other charges you may be paying.

While you’re at it Do not forget to download your e-statement as well. It will provide you with the printed version of your statement, with no trouble. Apart from that, this will notify you about the redraws you have made, as well as any other changes you’ve done to the loan.

You can also access information about your CPF accounts, IRAS statement, and several other loan-related documents on the HDB website. If you don’t have an HDB flat, you’ll have to sign up via SingPass. For instance you will need to sign the IRAS Notice of Assessment is one of the most important metrics for homeowners who are self-employed. Additionally, it is possible to pre-close your loan that is, you can pay off the loan prior to the time the loan is over.

Make sure you keep track of your payments

If you’re a client from HDB Financial Services, you can verify the status of your personal loan on the internet. It’s simple and easy. You can accomplish this by login to your internet bank account. This lets you track your loan amount and the length of time you’ll be paying the monthly installments. Furthermore, you can modify your contact information.

Similar to this, you can get also the HDB On the Go app through the Google PlayStore. After you download the app, you will be able to login and view the personal information about your loan. To sign in you will need to enter an account number for your mobile phone and your user name. Your password is a four-digit MPIN.

Another way to confirm the status of your loan is by going to the branch. The bank’s representative will assist you with all of your questions and can inform you the status of your loan immediately.

In addition to checking the status of your loan In addition, you may discuss terms on your loan with your bank. After your loan has been approved, you are able to begin paying EMI payments. If you keep making EMIs the balance of your loan will be reduced.

When you apply to get a loan for personal use you need to submit all the required forms. It is necessary to provide a valid identity evidence such as an PAN card or driving license. In addition, you should give a contact phone number and an account number for your loan. These are crucial in the management of your loan.

Furthermore you can get a personal loan statement on the HDB website. It will provide you with an overview of your loan information including rates of interest, penalties and EMIs. In addition, it will show the duration of the loan.

So, if contemplating applying for an individual loan it is important to apply as soon as possible. Personal loans offered by HDB Financial Services are available with attractive rates of interest. They offer flexible repayment periods. In addition, they’re not collateral-free.

They are therefore an ideal choice for salaried persons. Additionally, HDB Financial Services has more than 1,300 branches in Singapore. Additionally customers are able to receive individualized offers according to their needs. Therefore, if you’re in need of a speedy personal loan, look into applying for one at HDB Financial Services.

Contact HDB customer service

If you have questions regarding your personal loan you can reach HDB customer support. Alternately, you can utilize the portal online to view your account details. But, make sure to select the right assistance number in order not to pay any fraudulent charges.

If you’re applying for a loan you must provide Your Loan Account number (LAN) as well as a Ticket also known as Request Number. Status of the HDB personal loan will be determined on these two numbers. After you have provided these information, you are able to monitor your loan’s status using various methods.

If you’re not yet submitting your application, sign up your details through the website of your bank. After that, you’ll be taken to the support page for customers. To log in, you’ll be required to enter your login ID, password, and your mobile number. The information you provide is also used to verify your loan statements.

If you’re not satisfied with the services you received, you may make contact with for assistance from the Banking Ombudsman Service. This service is provided through the Reserve Bank of India. To avail this service, you will need to provide the bank’s response along with any other pertinent information. A nodal official can guarantee an answer within 15 working days.

If you’re unable to connect with the customer support via phone, you could go to the branch nearest to you. Branch hours are from 10:00 am until 4:00 pm, with the exception of National Holidays. During these hours, staff at customer service are on hand to answer your calls.

Contact HDB Financial Services Customer Care via toll-free numbers given below. The numbers are accessible by using a landline or mobile.

You can contact the customer service department to address your queries. In order to do this it is necessary to provide the specifics of your complaint as well as the response from your bank. You can also mail your grievances.

In addition to monitoring the status of your loan on line, you may monitor the progress of your loan in person. When you visit the branch of the bank or at the bank’s ATM, you can request your loan agent to inquire about whether your loan is in good standing. All of these steps are simple and easy.

A quick personal loan is sure to assist you with any financial requirement.