Choosing a blend of investments that fits your personal risk tolerance and investing profile can be challenging. In the United States, investors have a wealth of options when it comes to stocks, bonds, cryptocurrencies, and bullion assets. Finding the right kinds of investments is essential for making the kinds of gains that you want in a portfolio, and the truth is that identifying great opportunities doesn’t have to be an impossible task.

Begin with your own experiences for inspiration.

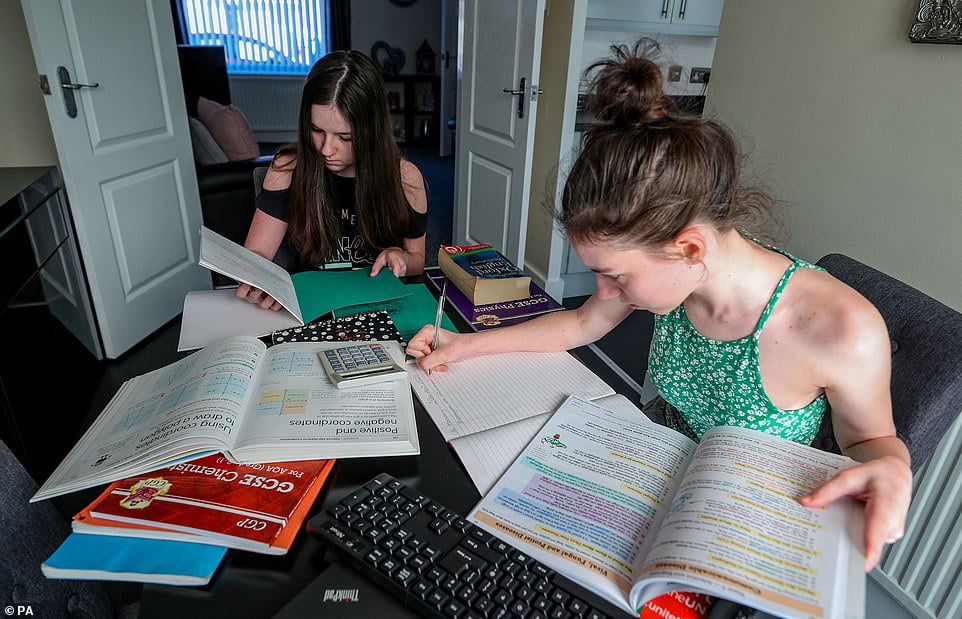

Beginners need to find innovation in the market somewhere. When you first begin trading stocks or other commodities, it can be a tough road to set out on as you are looking to make your first purchases. Relying on your own experiences and background can offer unexpected and sage wisdom when it comes to finding stocks and other investment opportunities to buy into for great returns. Couple this with rock solid reading and learning habits (perhaps through an MBA program, additional semesters and electives in the undergraduate setting, or through a concerted habit of daily self-guided reading) and you can expect to grow into a formidable investor in no time.

The NYSE (New York Stock Exchange) is filled with dividend aristocrats, growth-forward stock listings, and index and mutual funds that can boost your value over the long term. There are thousands of options to choose from, so beginning with the services, products, and tools that you use on a daily basis can form the baseline for a fantastic investment strategy going forward.

A great way to begin in this line of thinking is to simply walk around your home. What kinds of clothes do you wear? What model car is parked in your driveway? Which bank do you use? For those who are totally new to investing, these primer questions can get the juices flowing and help you to target long term winners that affect your daily lifestyle and cash flow.

Another great space for investment options is in the jewelry that you wear on a daily basis. A favorite pair of earrings might come from a specific and publicly traded brand that performs admirably on the stock exchange. Drop earrings, stud earrings, necklaces, and bracelets also make for great tangible investments, too, especially when made of sterling silver or ounces of gold. Jewelry purchases can serve in two purposes: Looking and feeling like a million bucks, and as a long term value generator that can eventually be sold for a solid profit.

Take your investment game to the next level.

Once you’ve found some inspiration in your daily life it’s time to take your strategy to the next level. It’s not enough to simply buy into the commodities that you use regularly. In order to create a portfolio filled with long term winners you will need to learn to read earnings reports, stock data, and news of the day that can affect the short term price movements that occur on a routine basis within every stock and commodity asset.

Many business-minded traders love the added weight of Business Administration Masters programs for making smart moves in the marketplace. No matter the asset class that you hone in on, MBA holders in the United States have a leg up over the competition as a result of their training and experienced eye for financial indicators and solid business metrics. those credit hours and conversations with the professor can really take your business and investment savvy to the next level.

Selecting market sectors takes foresight mixed with common sense thinking.

A great example of the advanced market spotting tactics that MBA program graduates take advantage of is in companies like Alamos Gold. Alamos is a North American gold mining outfit that operates mines in Mexico, the United States, and Canada (Young-Davidson, Island Gold, and the Mulatos Mine, in particular). The firm is a pioneer in sustainable extraction techniques and is breaking ground on exciting new projects in Turkey right now. The Kirazli project offers a game changer to investors as it appears to have a production yield rivaling some of Alamos’ greatest producers while also costing pennies on the dollar for sustainable extraction per ounce of gold.

Gold mining firms, like Alamos and other similar investment opportunities, provide great returns for investors. A high yielding dividend along with a promising growth factor puts Alamos at the top of a competitive pile in the industrial mining sector. While investors might think that ounces of gold are only really on offer through brokers who sell physical mineral reserves in the United States and around the world, the ability to invest in the means of production can often net better yields in the short term or for day trading purposes.

Other sectors share in these features. A list of health funds also offers the same types of returns for investors as medical science continues to produce modern miracles in the realm of prescription medication, vaccination research, and robust public health services. Covid-19 has reimagined the way that investors and everyday citizens interact with one another, the market, and a wide range of asset classes more broadly.

Health care stocks offer great value growth over time. Pharmaceuticals provide the consumer market with essential advances in medication and other health products that simply can’t be researched, designed, and produced by other cross-sectional brands, no matter their hulking size. This means that investors who buy into shares of health funds can expect a high yielding return as their portfolio continues to expand. The real question here is regarding the craft of selecting securities that show signs of continued growth. This is where MBA training from a school like Wharton or Harvard Business School, and years of experience in reading stock profiles and market reports can help you cut to the heart of the issue.

Additional investment opportunities come in many forms.

Outside of the stock market, entrepreneurship and the teachings from business school can take on many forms. Many investors choose to add jewelry, real estate holdings, and physical bullion assets to their portfolios for greater diversification. Investors find access to a host of investment opportunities in all walks of life.

Take inspiration from the things you use every day and leverage market insights and your own educational background in an MBA program (or in another certificate or degree program) to lock in fantastic returns for a lifetime of financial security.